Analysis Example¶

Multiple Objectives for Residential PV.

Import packages.¶

import os

import sys

sys.path.insert(0, os.path.abspath("../src"))

import numpy as np

import matplotlib.pyplot as pl

import pandas as pd

import seaborn as sb

import tyche as ty

from copy import deepcopy

from IPython.display import Image

Load data.¶

The data should be stored in a set of comma-separated value files in a sub-directory of the technology folder, as shown in the directory structure diagram (Fig. 1)

designs = ty.Designs("data/pv_residential_simple")

investments = ty.Investments("data/pv_residential_simple")

Compile the production and metric functions for each technology in the dataset.

designs.compile()

Examine the data.¶

The functions table specifies where the Python code for each technology resides.

designs.functions

| Style | Module | Capital | Fixed | Production | Metrics | Notes | |

|---|---|---|---|---|---|---|---|

| Technology | |||||||

| Residential PV | numpy | pv_residential_simple | capital_cost | fixed_cost | production | metrics |

Right now, only the style numpy is supported.

The indices table defines the subscripts for variables.

designs.indices

| Offset | Description | Notes | |||

|---|---|---|---|---|---|

| Technology | Type | Index | |||

| Residential PV | Capital | BoS | 2 | balance of system | |

| Inverter | 1 | system inverters | |||

| Module | 0 | system module | |||

| Fixed | System | 0 | whole system | ||

| Input | NaN | 0 | no inputs | ||

| Metric | GHG | 2 | reduction in GHGs | ||

| LCOE | 0 | reduction in levelized cost of energy | |||

| Labor | 1 | increase in spending on wages | |||

| Output | Electricity | 0 | electricity generated |

The designs table contains the cost, input, efficiency, and price data resulting from a Tranche.

designs.designs

| Value | Units | Notes | ||||

|---|---|---|---|---|---|---|

| Technology | Tranche | Variable | Index | |||

| Residential PV | 2015 Actual | Input | NaN | 0 | 1 | no inputs |

| Input efficiency | NaN | 1 | 1 | no inputs | ||

| Input price | NaN | 0 | 1 | no inputs | ||

| Lifetime | BoS | 1 | system-lifetime | per-lifetime computations | ||

| Inverter | 1 | system-lifetime | per-lifetime computations | |||

| ... | ... | ... | ... | ... | ... | |

| Module Slow Progress | Lifetime | Inverter | 1 | system-lifetime | per-lifetime computations | |

| Module | 1 | system-lifetime | per-lifetime computations | |||

| Output efficiency | Electricity | 1 | W/W | see parameter table for individual efficiencies | ||

| Output price | Electricity | 0 | $/kWh | not tracking electricity price | ||

| Scale | NaN | 1 | system/system | no scaling |

90 rows × 3 columns

The parameters table contains additional techno-economic parameters for each technology.

designs.parameters

| Offset | Value | Units | Notes | |||

|---|---|---|---|---|---|---|

| Technology | Tranche | Parameter | ||||

| Residential PV | 2015 Actual | Customer Acquisition | 19 | st.triang(0.5, loc=2000, scale=0.2) | $/system | BCA |

| DC-to-AC Ratio | 15 | st.triang(0.5, loc=1.4, scale=0.00014) | 1 | IDC | ||

| Direct Labor | 17 | st.triang(0.5, loc=2000, scale=0.2) | $/system | BLR | ||

| Discount Rate | 0 | 0.07 | 1/year | DR | ||

| Hardware Capital | 16 | st.triang(0.5, loc=80, scale=0.008) | $/m^2 | BCC | ||

| ... | ... | ... | ... | ... | ... | |

| Module Slow Progress | Module Lifetime | 4 | st.triang(0.5, loc=26, scale=1) | yr | MLT | |

| Module O&M Fixed | 7 | st.triang(0.5, loc=19, scale=0.5) | $/kWyr | MOM | ||

| Module Soiling Loss | 10 | st.triang(0.5, loc=0.05, scale=10E-06) | 1 | MSL | ||

| Permitting | 18 | st.triang(0.5, loc=600, scale=0.06) | $/system | BPR | ||

| System Size | 2 | 36 | m^2 | SSZ |

210 rows × 4 columns

The results table specifies the units of measure for results of computations.

designs.results

| Units | Notes | |||

|---|---|---|---|---|

| Technology | Variable | Index | ||

| Residential PV | Cost | Cost | $/system | |

| Metric | GHG | ΔgCO2e/system | ||

| LCOE | Δ$/kWh | |||

| Labor | Δ$/system | |||

| Output | Electricity | kWh |

The tranches table specifies multually exclusive possibilities for investments: only one Tranch may be selected for each Category.

investments.tranches

| Amount | Notes | |||

|---|---|---|---|---|

| Category | Tranche | |||

| BoS R&D | BoS High R&D | BoS Fast Progress | 900000.0 | |

| BoS Low R&D | BoS Slow Progress | 300000.0 | ||

| BoS Medium R&D | BoS Moderate Progress | 600000.0 | ||

| Inverter R&D | Inverter High R&D | Inverter Fast Progress | 3000000.0 | |

| Inverter Low R&D | Inverter Slow Progress | 1000000.0 | ||

| Inverter Medium R&D | Inverter Moderate Progress | 2000000.0 | ||

| Module R&D | Module High R&D | Module Fast Progress | 4500000.0 | |

| Module Low R&D | Module Slow Progress | 1500000.0 | ||

| Module Medium R&D | Module Moderate Progress | 3000000.0 |

The investments table bundles a consistent set of tranches (one per category) into an overall investment.

investments.investments

| Notes | |||

|---|---|---|---|

| Investment | Category | Tranche | |

| High R&D | BoS R&D | BoS High R&D | |

| Inverter R&D | Inverter High R&D | ||

| Module R&D | Module High R&D | ||

| Low R&D | BoS R&D | BoS Low R&D | |

| Inverter R&D | Inverter Low R&D | ||

| Module R&D | Module Low R&D | ||

| Medium R&D | BoS R&D | BoS Medium R&D | |

| Inverter R&D | Inverter Medium R&D | ||

| Module R&D | Module Medium R&D |

Evaluate the Tranches in the dataset.¶

tranche_results = designs.evaluate_tranches(sample_count=50)

tranche_results.xs(1, level="Sample", drop_level=False)

| Value | Units | |||||

|---|---|---|---|---|---|---|

| Technology | Tranche | Sample | Variable | Index | ||

| Residential PV | 2015 Actual | 1 | Cost | Cost | 19541.835826 | $/system |

| Metric | GHG | -0.001761 | ΔgCO2e/system | |||

| LCOE | -0.000019 | Δ$/kWh | ||||

| Labor | -0.001281 | Δ$/system | ||||

| Output | Electricity | 184107.032791 | kWh | |||

| BoS Fast Progress | 1 | Cost | Cost | 17524.525245 | $/system | |

| Metric | GHG | -0.004254 | ΔgCO2e/system | |||

| LCOE | 0.010936 | Δ$/kWh | ||||

| Labor | -545.200985 | Δ$/system | ||||

| Output | Electricity | 184101.481909 | kWh | |||

| BoS Moderate Progress | 1 | Cost | Cost | 17960.467902 | $/system | |

| Metric | GHG | -0.001253 | ΔgCO2e/system | |||

| LCOE | 0.008571 | Δ$/kWh | ||||

| Labor | -331.852654 | Δ$/system | ||||

| Output | Electricity | 184108.162865 | kWh | |||

| BoS Slow Progress | 1 | Cost | Cost | 19022.884313 | $/system | |

| Metric | GHG | 0.000327 | ΔgCO2e/system | |||

| LCOE | 0.002802 | Δ$/kWh | ||||

| Labor | -148.230849 | Δ$/system | ||||

| Output | Electricity | 184111.682213 | kWh | |||

| Inverter Fast Progress | 1 | Cost | Cost | 18059.997438 | $/system | |

| Metric | GHG | 2.601021 | ΔgCO2e/system | |||

| LCOE | 0.011024 | Δ$/kWh | ||||

| Labor | -0.031111 | Δ$/system | ||||

| Output | Electricity | 189903.145647 | kWh | |||

| Inverter Moderate Progress | 1 | Cost | Cost | 18713.047656 | $/system | |

| Metric | GHG | 2.537671 | ΔgCO2e/system | |||

| LCOE | 0.007512 | Δ$/kWh | ||||

| Labor | -0.034240 | Δ$/system | ||||

| Output | Electricity | 189762.072909 | kWh | |||

| Inverter Slow Progress | 1 | Cost | Cost | 19224.862899 | $/system | |

| Metric | GHG | 2.435100 | ΔgCO2e/system | |||

| LCOE | 0.004693 | Δ$/kWh | ||||

| Labor | 0.056486 | Δ$/system | ||||

| Output | Electricity | 189533.659025 | kWh | |||

| Module Fast Progress | 1 | Cost | Cost | 18935.973204 | $/system | |

| Metric | GHG | 51.490235 | ΔgCO2e/system | |||

| LCOE | 0.042746 | Δ$/kWh | ||||

| Labor | 0.013583 | Δ$/system | ||||

| Output | Electricity | 298774.134685 | kWh | |||

| Module Moderate Progress | 1 | Cost | Cost | 18952.058689 | $/system | |

| Metric | GHG | 41.216046 | ΔgCO2e/system | |||

| LCOE | 0.037432 | Δ$/kWh | ||||

| Labor | 0.029792 | Δ$/system | ||||

| Output | Electricity | 275894.626758 | kWh | |||

| Module Slow Progress | 1 | Cost | Cost | 19656.198525 | $/system | |

| Metric | GHG | 14.794693 | ΔgCO2e/system | |||

| LCOE | 0.015567 | Δ$/kWh | ||||

| Labor | -0.007250 | Δ$/system | ||||

| Output | Electricity | 217057.134731 | kWh |

Save results.¶

tranche_results.to_csv("output/pv_residential_simple/example-analysis.csv")

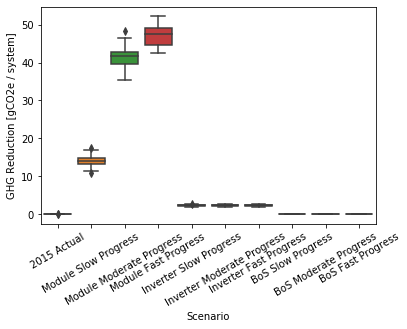

Plot GHG metric.¶

g = sb.boxplot(

x="Tranche",

y="Value",

data=tranche_results.xs(

["Metric", "GHG"],

level=["Variable", "Index"]

).reset_index()[["Tranche", "Value"]],

order=[

"2015 Actual" ,

"Module Slow Progress" ,

"Module Moderate Progress" ,

"Module Fast Progress" ,

"Inverter Slow Progress" ,

"Inverter Moderate Progress",

"Inverter Fast Progress" ,

"BoS Slow Progress" ,

"BoS Moderate Progress" ,

"BoS Fast Progress" ,

]

)

g.set(ylabel="GHG Reduction [gCO2e / system]")

g.set_xticklabels(g.get_xticklabels(), rotation=30);

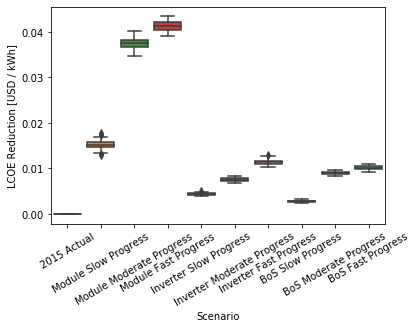

Plot LCOE metric.¶

g = sb.boxplot(

x="Tranche",

y="Value",

data=tranche_results.xs(

["Metric", "LCOE"],

level=["Variable", "Index"]

).reset_index()[["Tranche", "Value"]],

order=[

"2015 Actual" ,

"Module Slow Progress" ,

"Module Moderate Progress" ,

"Module Fast Progress" ,

"Inverter Slow Progress" ,

"Inverter Moderate Progress",

"Inverter Fast Progress" ,

"BoS Slow Progress" ,

"BoS Moderate Progress" ,

"BoS Fast Progress" ,

]

)

g.set(ylabel="LCOE Reduction [USD / kWh]")

g.set_xticklabels(g.get_xticklabels(), rotation=30);

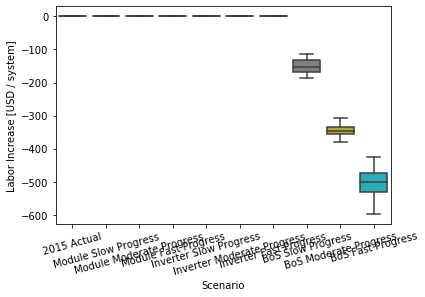

Plot labor metric.¶

g = sb.boxplot(

x="Tranche",

y="Value",

data=tranche_results.xs(

["Metric", "Labor"],

level=["Variable", "Index"]

).reset_index()[["Tranche", "Value"]],

order=[

"2015 Actual" ,

"Module Slow Progress" ,

"Module Moderate Progress" ,

"Module Fast Progress" ,

"Inverter Slow Progress" ,

"Inverter Moderate Progress",

"Inverter Fast Progress" ,

"BoS Slow Progress" ,

"BoS Moderate Progress" ,

"BoS Fast Progress" ,

]

)

g.set(ylabel="Labor Increase [USD / system]")

g.set_xticklabels(g.get_xticklabels(), rotation=15);

Evaluate the investments in the dataset.¶

investment_results = investments.evaluate_investments(designs, sample_count=50)

Costs of investments.¶

investment_results.amounts

| Amount | |

|---|---|

| Investment | |

| High R&D | 8400000.0 |

| Low R&D | 2800000.0 |

| Medium R&D | 5600000.0 |

Benefits of investments.¶

investment_results.metrics.xs(1, level="Sample", drop_level=False)

| Value | Units | |||||||

|---|---|---|---|---|---|---|---|---|

| Investment | Category | Tranche | Sample | Technology | Index | |||

| High R&D | BoS R&D | BoS High R&D | BoS Fast Progress | 1 | Residential PV | GHG | 0.001646 | ΔgCO2e/system |

| LCOE | 0.009871 | Δ$/kWh | ||||||

| Labor | -484.675917 | Δ$/system | ||||||

| Medium R&D | BoS R&D | BoS Medium R&D | BoS Moderate Progress | 1 | Residential PV | GHG | -0.005431 | ΔgCO2e/system |

| LCOE | 0.009181 | Δ$/kWh | ||||||

| Labor | -350.111301 | Δ$/system | ||||||

| Low R&D | BoS R&D | BoS Low R&D | BoS Slow Progress | 1 | Residential PV | GHG | -0.000623 | ΔgCO2e/system |

| LCOE | 0.002863 | Δ$/kWh | ||||||

| Labor | -165.967402 | Δ$/system | ||||||

| High R&D | Inverter R&D | Inverter High R&D | Inverter Fast Progress | 1 | Residential PV | GHG | 2.366737 | ΔgCO2e/system |

| LCOE | 0.011084 | Δ$/kWh | ||||||

| Labor | 0.034014 | Δ$/system | ||||||

| Medium R&D | Inverter R&D | Inverter Medium R&D | Inverter Moderate Progress | 1 | Residential PV | GHG | 2.385654 | ΔgCO2e/system |

| LCOE | 0.007551 | Δ$/kWh | ||||||

| Labor | 0.016533 | Δ$/system | ||||||

| Low R&D | Inverter R&D | Inverter Low R&D | Inverter Slow Progress | 1 | Residential PV | GHG | 2.562178 | ΔgCO2e/system |

| LCOE | 0.004598 | Δ$/kWh | ||||||

| Labor | 0.081408 | Δ$/system | ||||||

| High R&D | Module R&D | Module High R&D | Module Fast Progress | 1 | Residential PV | GHG | 50.680545 | ΔgCO2e/system |

| LCOE | 0.043544 | Δ$/kWh | ||||||

| Labor | -0.014162 | Δ$/system | ||||||

| Medium R&D | Module R&D | Module Medium R&D | Module Moderate Progress | 1 | Residential PV | GHG | 41.065128 | ΔgCO2e/system |

| LCOE | 0.037053 | Δ$/kWh | ||||||

| Labor | -0.010921 | Δ$/system | ||||||

| Low R&D | Module R&D | Module Low R&D | Module Slow Progress | 1 | Residential PV | GHG | 12.916316 | ΔgCO2e/system |

| LCOE | 0.013848 | Δ$/kWh | ||||||

| Labor | 0.057653 | Δ$/system |

investment_results.summary.xs(1, level="Sample", drop_level=False)

| Value | Units | |||

|---|---|---|---|---|

| Investment | Sample | Index | ||

| High R&D | 1 | GHG | 53.048928 | ΔgCO2e/system |

| LCOE | 0.064500 | Δ$/kWh | ||

| Labor | -484.656066 | Δ$/system | ||

| Medium R&D | 1 | GHG | 43.445350 | ΔgCO2e/system |

| LCOE | 0.053785 | Δ$/kWh | ||

| Labor | -350.105690 | Δ$/system | ||

| Low R&D | 1 | GHG | 15.477872 | ΔgCO2e/system |

| LCOE | 0.021309 | Δ$/kWh | ||

| Labor | -165.828341 | Δ$/system |

Save results.¶

investment_results.amounts.to_csv("output/pv_residential_simple/example-investment-amounts.csv")

investment_results.metrics.to_csv("output/pv_residential_simple/example-investment-metrics.csv")

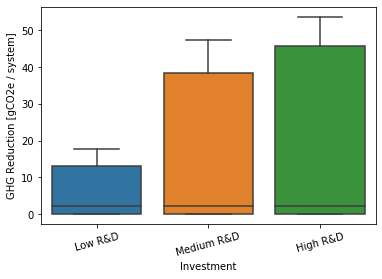

Plot GHG metric.¶

g = sb.boxplot(

x="Investment",

y="Value",

data=investment_results.metrics.xs(

"GHG",

level="Index"

).reset_index()[["Investment", "Value"]],

order=[

"Low R&D" ,

"Medium R&D",

"High R&D" ,

]

)

g.set(ylabel="GHG Reduction [gCO2e / system]")

g.set_xticklabels(g.get_xticklabels(), rotation=15);

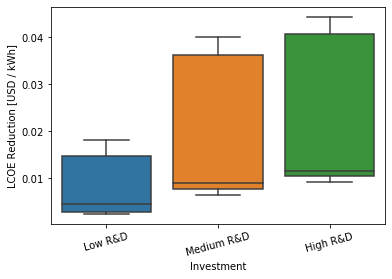

Plot LCOE metric.¶

g = sb.boxplot(

x="Investment",

y="Value",

data=investment_results.metrics.xs(

"LCOE",

level="Index"

).reset_index()[["Investment", "Value"]],

order=[

"Low R&D" ,

"Medium R&D",

"High R&D" ,

]

)

g.set(ylabel="LCOE Reduction [USD / kWh]")

g.set_xticklabels(g.get_xticklabels(), rotation=15);

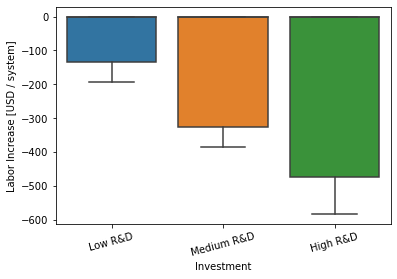

Plot labor metric.¶

g = sb.boxplot(

x="Investment",

y="Value",

data=investment_results.metrics.xs(

"Labor",

level="Index"

).reset_index()[["Investment", "Value"]],

order=[

"Low R&D" ,

"Medium R&D",

"High R&D" ,

]

)

g.set(ylabel="Labor Increase [USD / system]")

g.set_xticklabels(g.get_xticklabels(), rotation=15);

Multi-objective decision analysis.¶

Compute costs and metrics for tranches.¶

Tranches are atomic units for building investment portfolios. Evaluate all of the tranches, so we can assemble them into investments (portfolios).

tranche_results = investments.evaluate_tranches(designs, sample_count=50)

Display the cost of each tranche.

tranche_results.amounts

| Amount | ||

|---|---|---|

| Category | Tranche | |

| BoS R&D | BoS High R&D | 900000.0 |

| BoS Low R&D | 300000.0 | |

| BoS Medium R&D | 600000.0 | |

| Inverter R&D | Inverter High R&D | 3000000.0 |

| Inverter Low R&D | 1000000.0 | |

| Inverter Medium R&D | 2000000.0 | |

| Module R&D | Module High R&D | 4500000.0 |

| Module Low R&D | 1500000.0 | |

| Module Medium R&D | 3000000.0 |

Display the metrics for each tranche.

tranche_results.summary

| Value | Units | ||||

|---|---|---|---|---|---|

| Category | Tranche | Sample | Index | ||

| BoS R&D | BoS High R&D | 1 | GHG | -0.004062 | ΔgCO2e/system |

| LCOE | 0.009967 | Δ$/kWh | |||

| Labor | -490.859314 | Δ$/system | |||

| 2 | GHG | 0.001960 | ΔgCO2e/system | ||

| LCOE | 0.010154 | Δ$/kWh | |||

| ... | ... | ... | ... | ... | ... |

| Module R&D | Module Low R&D | 49 | LCOE | 0.016198 | Δ$/kWh |

| Labor | 0.039788 | Δ$/system | |||

| 50 | GHG | 13.654483 | ΔgCO2e/system | ||

| LCOE | 0.014910 | Δ$/kWh | |||

| Labor | -0.015539 | Δ$/system |

1350 rows × 2 columns

Save the results.

tranche_results.amounts.to_csv("output/pv_residential_simple/example-tranche-amounts.csv")

tranche_results.summary.to_csv("output/pv_residential_simple/example-tranche-summary.csv")

Fit a response surface to the results.¶

The response surface interpolates between the discrete set of cases provided in the expert elicitation. This allows us to study funding levels intermediate between the pre-defined Tranches.

evaluator = ty.Evaluator(investments.tranches, tranche_results.summary)

Here are the categories of investment and the maximum amount that could be invested in each:

evaluator.max_amount

| Amount | |

|---|---|

| Category | |

| BoS R&D | 900000.0 |

| Inverter R&D | 3000000.0 |

| Module R&D | 4500000.0 |

Here are the metrics and their units of measure:

evaluator.units

| Units | |

|---|---|

| Index | |

| GHG | ΔgCO2e/system |

| LCOE | Δ$/kWh |

| Labor | Δ$/system |

Example interpolation.¶

Let’s evaluate the case where each category is invested in at half of its maximum amount.

example_investments = evaluator.max_amount / 2

example_investments

| Amount | |

|---|---|

| Category | |

| BoS R&D | 450000.0 |

| Inverter R&D | 1500000.0 |

| Module R&D | 2250000.0 |

evaluator.evaluate(example_investments)

Category Index Sample

BoS R&D GHG 1 -0.0010586097518157094

2 7.493162517135921e-05

3 0.001253893601450784

4 -0.00398626797827717

5 -0.005572343870333896

...

Module R&D Labor 46 0.014371009324918305

47 0.011128728287076228

48 0.0039832773605894545

49 0.006026680267950724

50 0.028844695933457842

Name: Value, Length: 450, dtype: object

Let’s evaluate the mean instead of outputing the whole distribution.

evaluator.evaluate_statistic(example_investments, np.mean)

Index

GHG 30.156830

LCOE 0.038160

Labor -246.843027

Name: Value, dtype: float64

Here is the standard deviation:

evaluator.evaluate_statistic(example_investments, np.std)

Index

GHG 1.410956

LCOE 0.000850

Labor 16.070395

Name: Value, dtype: float64

A risk-averse decision maker might be interested in the 10% percentile:

evaluator.evaluate_statistic(example_investments, lambda x: np.quantile(x, 0.1))

Index

GHG 28.573627

LCOE 0.037140

Labor -268.059699

Name: Value, dtype: float64

ε-Constraint multiobjective optimization¶

optimizer = ty.EpsilonConstraintOptimizer(evaluator)

In order to meaningfully map the decision space, we need to know the maximum values for each of the metrics.

metric_max = optimizer.max_metrics()

metric_max

GHG 49.429976

LCOE 0.062818

Labor 0.049555

Name: Value, dtype: float64

Example optimization.¶

Limit spending to $3M.

investment_max = 3e6

Require that the GHG reduction be at least 40 gCO2e/system and that the Labor wages not decrease.

metric_min = pd.Series([40, 0], name = "Value", index = ["GHG", "Labor"])

metric_min

GHG 40

Labor 0

Name: Value, dtype: int64

Compute the ε-constrained maximum for the LCOE.

optimum = optimizer.maximize(

"LCOE" ,

total_amount = investment_max,

min_metric = metric_min ,

statistic = np.mean ,

)

optimum.exit_message

'Optimization terminated successfully.'

Here are the optimal spending levels:

np.round(optimum.amounts)

Category

BoS R&D 0.0

Inverter R&D 0.0

Module R&D 3000000.0

Name: Amount, dtype: float64

Here are the three metrics at that optimum:

optimum.metrics

Index

GHG 41.627691

LCOE 0.037566

Labor 0.028691

Name: Value, dtype: float64

Thus, by putting all of the investment into Module R&D, we can expected to achieve a mean 3.75 ¢/kWh reduction in LCOE under the GHG and Labor constraints.

It turns out that there is no solution for these constraints if we evaluate the 10th percentile of the metrics, for a risk-averse decision maker.

optimum = optimizer.maximize(

"LCOE" ,

total_amount = investment_max,

min_metric = metric_min ,

statistic = lambda x: np.quantile(x, 0.1),

)

optimum.exit_message

'Iteration limit exceeded'

Let’s try again, but with a less stringent set of constraints, only constraining GHG somewhat but not Labor at all.

optimum = optimizer.maximize(

"LCOE" ,

total_amount = investment_max ,

min_metric = pd.Series([30], name = "Value", index = ["GHG"]),

statistic = lambda x: np.quantile(x, 0.1) ,

)

optimum.exit_message

'Optimization terminated successfully.'

np.round(optimum.amounts)

Category

BoS R&D 0.0

Inverter R&D 0.0

Module R&D 3000000.0

Name: Amount, dtype: float64

optimum.metrics

Index

GHG 39.046988

LCOE 0.036463

Labor -0.019725

Name: Value, dtype: float64

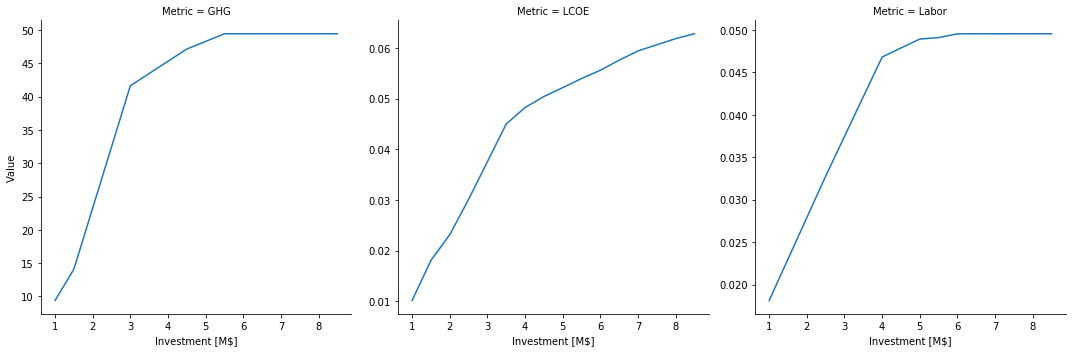

Pareto surfaces.¶

Metrics constrained by total investment.¶

pareto_amounts = None

for investment_max in np.arange(1e6, 9e6, 0.5e6):

metrics = optimizer.max_metrics(total_amount = investment_max)

pareto_amounts = pd.DataFrame(

[metrics.values] ,

columns = metrics.index.values ,

index = pd.Index([investment_max / 1e6], name = "Investment [M$]"),

).append(pareto_amounts)

pareto_amounts

| GHG | LCOE | Labor | |

|---|---|---|---|

| Investment [M$] | |||

| 8.5 | 49.429976 | 0.062818 | 0.049555 |

| 8.0 | 49.429976 | 0.061848 | 0.049555 |

| 7.5 | 49.429976 | 0.060635 | 0.049555 |

| 7.0 | 49.429976 | 0.059423 | 0.049555 |

| 6.5 | 49.429976 | 0.057592 | 0.049560 |

| 6.0 | 49.426992 | 0.055608 | 0.049545 |

| 5.5 | 49.424007 | 0.053976 | 0.049104 |

| 5.0 | 48.278589 | 0.052171 | 0.048930 |

| 4.5 | 47.133172 | 0.050431 | 0.047878 |

| 4.0 | 45.298011 | 0.048243 | 0.046810 |

| 3.5 | 43.462851 | 0.045006 | 0.042130 |

| 3.0 | 41.627691 | 0.037569 | 0.037450 |

| 2.5 | 32.453455 | 0.030129 | 0.032769 |

| 2.0 | 23.279219 | 0.023166 | 0.027886 |

| 1.5 | 14.104983 | 0.018081 | 0.023003 |

| 1.0 | 9.403322 | 0.010170 | 0.018119 |

sb.relplot(

x = "Investment [M$]",

y = "Value" ,

col = "Metric" ,

kind = "line" ,

facet_kws = {'sharey': False},

data = pareto_amounts.reset_index().melt(id_vars = "Investment [M$]", var_name = "Metric", value_name = "Value")

)

<seaborn.axisgrid.FacetGrid at 0x7f9da11752b0>

We see that the LCOE metric saturates more slowly than the GHG and Labor ones.

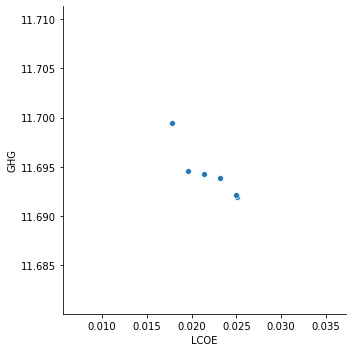

GHG vs LCOE, constrained by total investment.¶

investment_max = 3

pareto_ghg_lcoe = None

for lcoe_min in 0.95 * np.arange(0.5, 0.9, 0.05) * pareto_amounts.loc[investment_max, "LCOE"]:

optimum = optimizer.maximize(

"GHG",

max_amount = pd.Series([0.9e6, 3.0e6, 1.0e6], name = "Amount", index = ["BoS R&D", "Inverter R&D", "Module R&D"]),

total_amount = investment_max * 1e6 ,

min_metric = pd.Series([lcoe_min], name = "Value", index = ["LCOE"]),

)

pareto_ghg_lcoe = pd.DataFrame(

[[investment_max, lcoe_min, optimum.metrics["LCOE"], optimum.metrics["GHG"], optimum.exit_message]],

columns = ["Investment [M$]", "LCOE (min)", "LCOE", "GHG", "Result"] ,

).append(pareto_ghg_lcoe)

pareto_ghg_lcoe = pareto_ghg_lcoe.set_index(["Investment [M$]", "LCOE (min)"])

pareto_ghg_lcoe

| LCOE | GHG | Result | ||

|---|---|---|---|---|

| Investment [M$] | LCOE (min) | |||

| 3 | 0.030337 | 0.025037 | 11.691901 | Positive directional derivative for linesearch |

| 0.028553 | 0.025037 | 11.691901 | Positive directional derivative for linesearch | |

| 0.026768 | 0.025037 | 11.691901 | Positive directional derivative for linesearch | |

| 0.024983 | 0.024983 | 11.692188 | Optimization terminated successfully. | |

| 0.023199 | 0.023199 | 11.693916 | Optimization terminated successfully. | |

| 0.021414 | 0.021414 | 11.694230 | Optimization terminated successfully. | |

| 0.019630 | 0.019630 | 11.694544 | Optimization terminated successfully. | |

| 0.017845 | 0.017845 | 11.699478 | Optimization terminated successfully. |

sb.relplot(

x = "LCOE",

y = "GHG",

kind = "scatter",

data = pareto_ghg_lcoe#[pareto_ghg_lcoe.Result == "Optimization terminated successfully."]

)

<seaborn.axisgrid.FacetGrid at 0x7f9da13ae630>

The three types of investment are too decoupled to make an interesting pareto frontier, and we also need a better solver if we want to push to lower right.

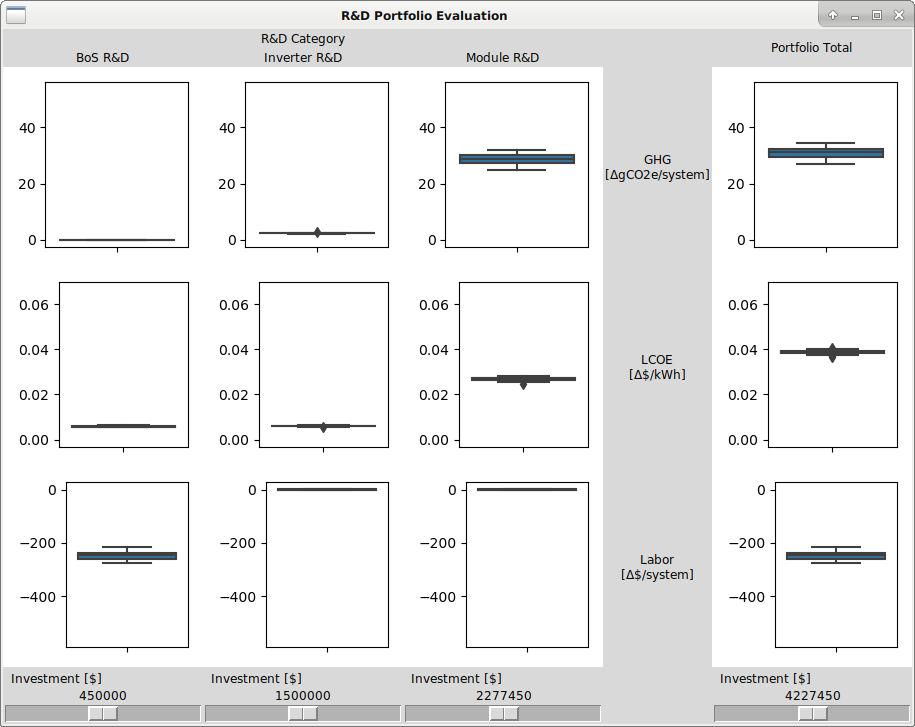

Run the interactive explorer for the decision space.¶

Make sure the the tk package is installed on your machine. Here is

the Anaconda link: https://anaconda.org/anaconda/tk.

w = ty.DecisionWindow(evaluator)

w.mainloop()

A new window should open that looks like the image below. Moving the sliders will cause a recomputation of the boxplots.

Image("pv_residential_simple_gui.png")