SAM Economic Models: Multiple Construction Years¶

Multiple Construction Years example web interface link

GEOPHIRES SAM Economic Models support multi-year construction timelines to deliver accurate, time-adjusted financial metrics, including IRR and NPV, for projects with extended development periods. This feature models the pre-revenue phase to capture the real-world economic impact of Interest During Construction ( IDC), inflation, and capital deployment timing. This ensures that key investment decision metrics correctly reflect the time value of money leading up to the Commercial Operation Date (COD).

To enable this feature, set the Construction Years parameter to the desired duration (e.g., 3). The spending profile

is defined by the Construction CAPEX Schedule, which allocates a percentage of the Overnight Capital Cost to each

pre-revenue year. Users can further refine the financing model using Bond Financing Start Year to delay debt

drawdowns (funding early years purely with equity) and adjust Inflation Rate During Construction or

Inflated Bond Interest Rate During Construction to match specific market conditions.

Construction Cash Flows¶

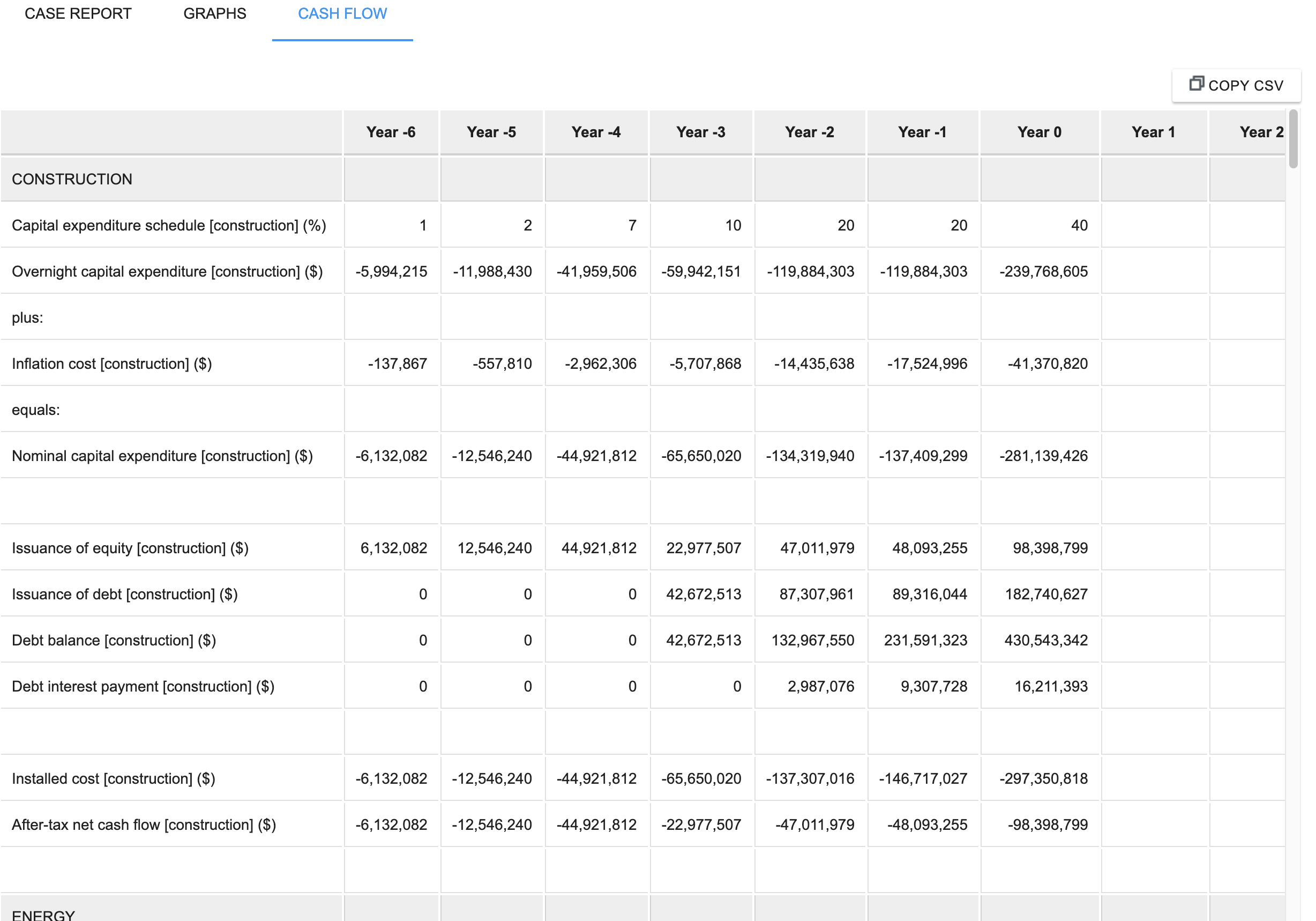

The CONSTRUCTION cash flow category displays detailed financial movements during the pre-operational phase.

Construction-specific line items are suffixed with [construction].

Construction years are indexed relative to the first year of operations (Year 1).

A project with three construction years will have cash flows in Year -2, Year -1 and Year 0.

A project with seven construction years, as in the example below, will start in Year -6.

Construction Years Calculations¶

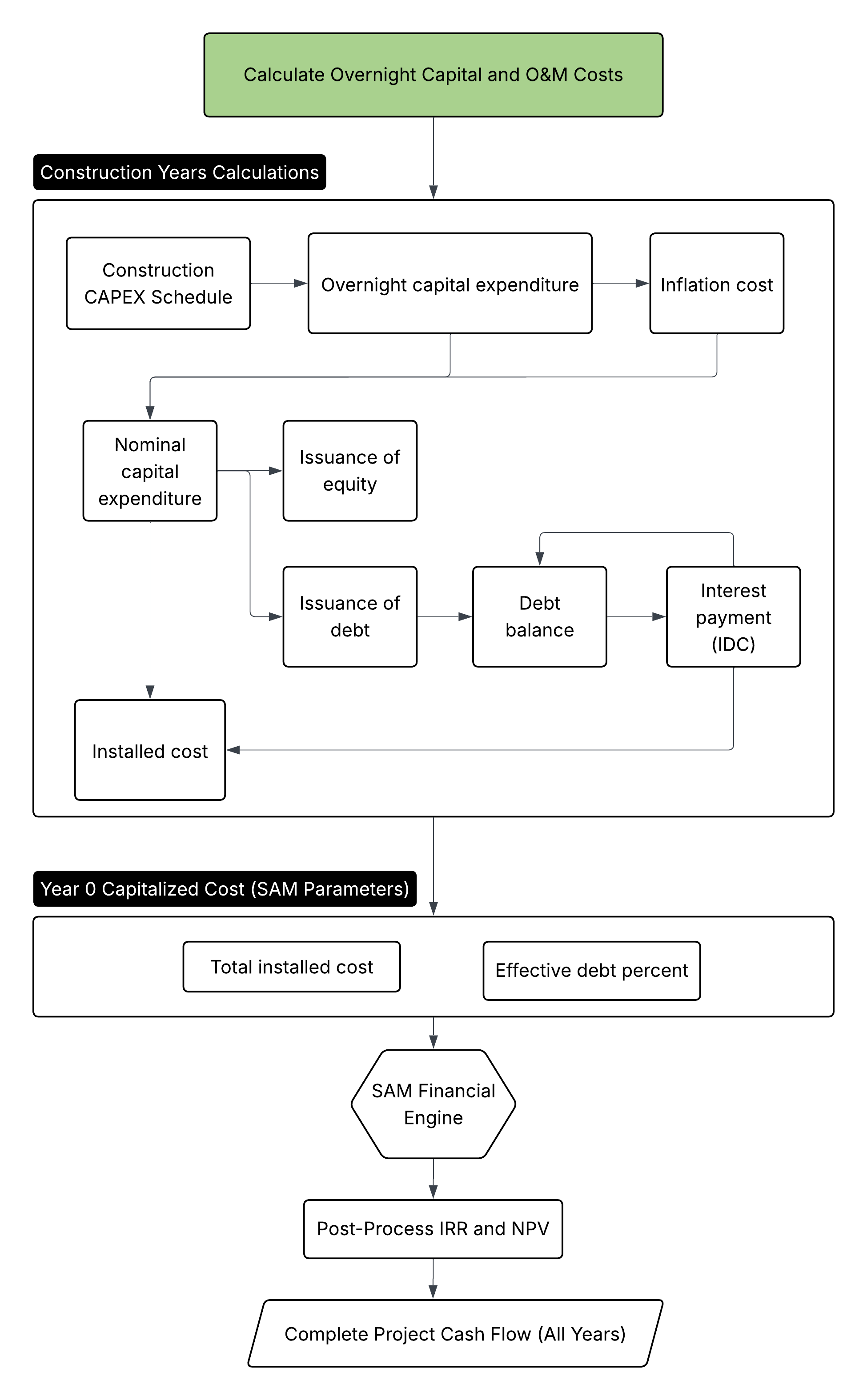

For each construction year, the CONSTRUCTION cash flow is calculated as follows:

CAPEX Deployment: GEOPHIRES calculates

Overnight capital expenditure [construction]as a percentage of the totalOvernight Capital Costbased on theConstruction CAPEX Schedule.Inflation: An inflation adder is calculated using

Inflation Rate During Constructionand added to the overnight cost to yieldNominal capital expenditure [construction].Debt & Equity Draws: Costs are covered by issuance of equity and debt based on

Fraction of Investment in Bonds. Debt financing can be delayed by specifyingBond Financing Start Year. Years prior to this threshold are financed 100% by equity.IDC (Interest During Construction): Interest on the accumulated debt balance is calculated using

Inflated Bond Interest Rate During Construction. This interest is capitalized (added toDebt balance [construction]) rather than paid out as cash.Annual Installed Cost: The annual

Installed cost [construction]is the sum ofNominal capital expenditure [construction]andDebt interest payment [construction](capitalized IDC).

Operational Years (SAM Integration)¶

At the end of the construction phase, total installed cost and effective debt percentage are passed to the SAM financial

engine.

This ensures the operational model starts with the correct depreciation basis and loan principal.

Annual Installed cost [construction] values are

summed to calculate the total installed cost that is passed to SAM (total_installed_cost).

Issuance of equity [construction] and Issuance of debt [construction] are summed to compute an effective debt:equity

ratio that is passed to SAM (debt_percent).

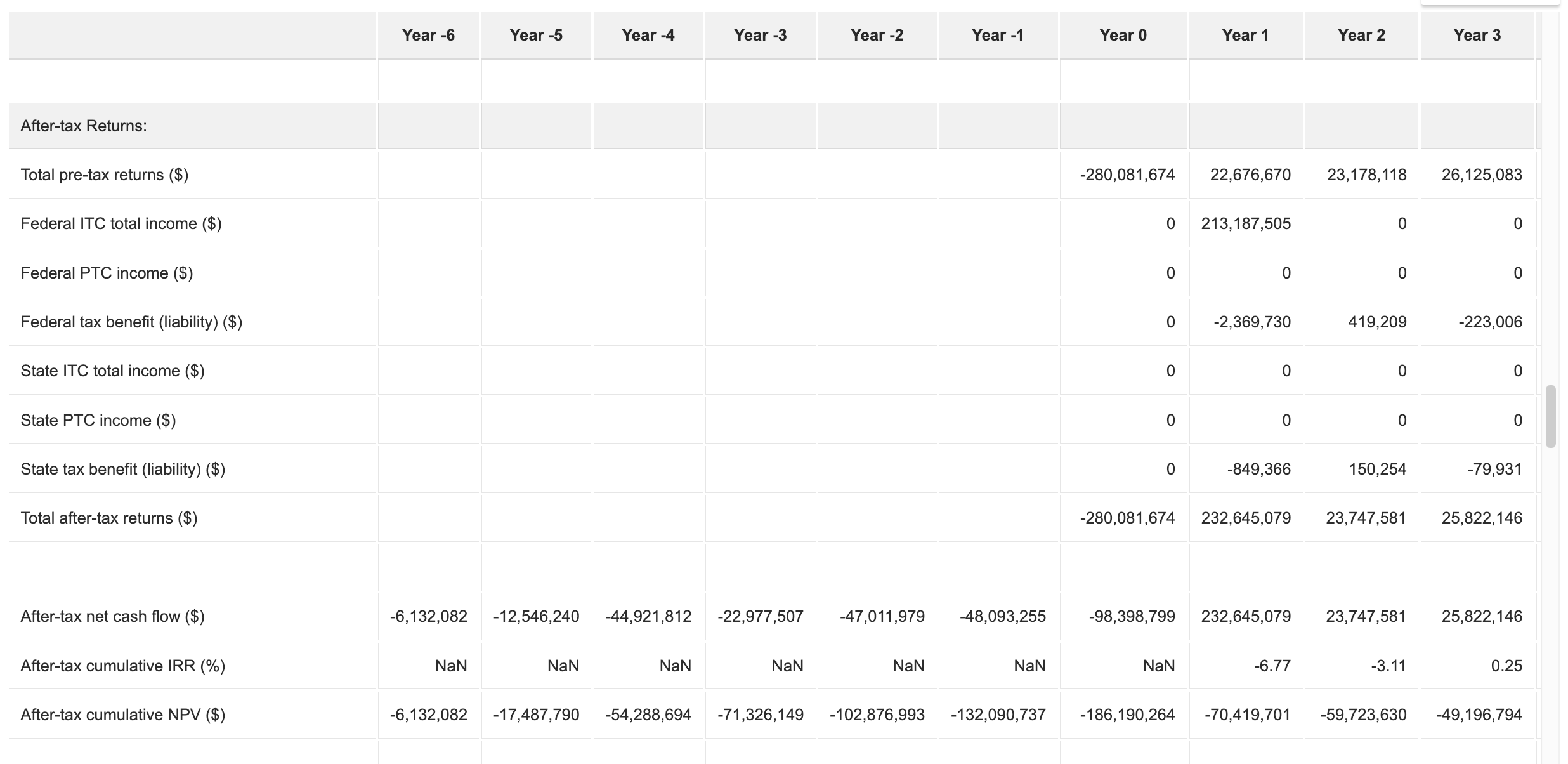

Post-Processing (Timeline-adjusted Metrics)¶

After SAM computes the operational cash flows, GEOPHIRES merges the construction phase and

operational phase net cash flows together to report accurate project-level metrics including IRR and NPV.

The merged After-tax net cash flow ($) row represents the complete project lifecycle:

Years -N to 0: Contains

After-tax net cash flow [construction] ($)(equity outflows).Years 1+: Contains

Total after-tax returns ($)from operations.

After-tax cumulative IRR (%) and After-tax cumulative NPV ($) are re-calculated based on this unified cash flow

stream to account for the time value of money during the construction delay.

The corresponding result case report metrics (After-tax IRR and Project NPV) reflect this adjustment,

as do other relevant case report metrics including Project VIR=PI=PIR and Project MOIC.